A Comprehensive Guide to Buying a House in London 2025

House prices in the UK are currently on the rise, and the rate has surged beyond 4% which is quite an increment from the previous years’ 2.5%. Surprisingly, the best of all news for those planning to buy a property in London is, since November 2024, property prices in London have only taken a meagre increase. Yes, according to data from HM Land Registry, property prices in the England capital are 0.1% lower compared to the previous year. While house prices in regions like in the South-East experienced a surge with average house price standing at £378,000, the lowest average house price was found in the North-East at £169,000.

The average house price in London for January was priced at about £511,280, while in November, the average house price was £510,000. Though this is a month-on-month statistic, the number has only witnessed a moderate increase.

Now that we have some clarity with regards to house prices, its’ time to look into the meat of the matter; buying a property in London. Before we deep dive into the how’s of buying a house in London, let’s look at why this is a great time to those investing. So, if you are an investor, this could be a great time to invest your money on a property in London.

Why this is a Great Time to Invest on a Property in London?

1. Increased Rentals

2. Flexibility & Diversity

3. An Economic Hub

4. Scarcity of Land

5. Strong Future Prospects

First Home Scheme for First Time Buyers

If you are a first-time buyer, you will be able to buy your first home in London for a price 30-50% less than its original market price. For example, if the property you are planning to buy has a market value of £100,000 you can then buy the property with a discount of 30% which reduces the house price by £30,000. So, the total price you will end up paying will be £70,000.

Who are Eligible for the First Home Scheme?

- You are a local (must have worked, lived in the area, grew up in the area or have a family) and have a low household income.

- Keyworkers (as defined by your council) and includes doctors, nurses, social workers, frontline health workers, midwives, etc.

- A member of the armed forces or a divorced spouse, partner of the member of the armed forces.

- A widow or a widower of a deceased member of the armed forces.

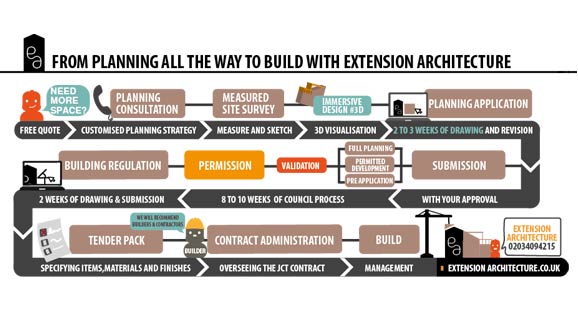

Buying a House in London

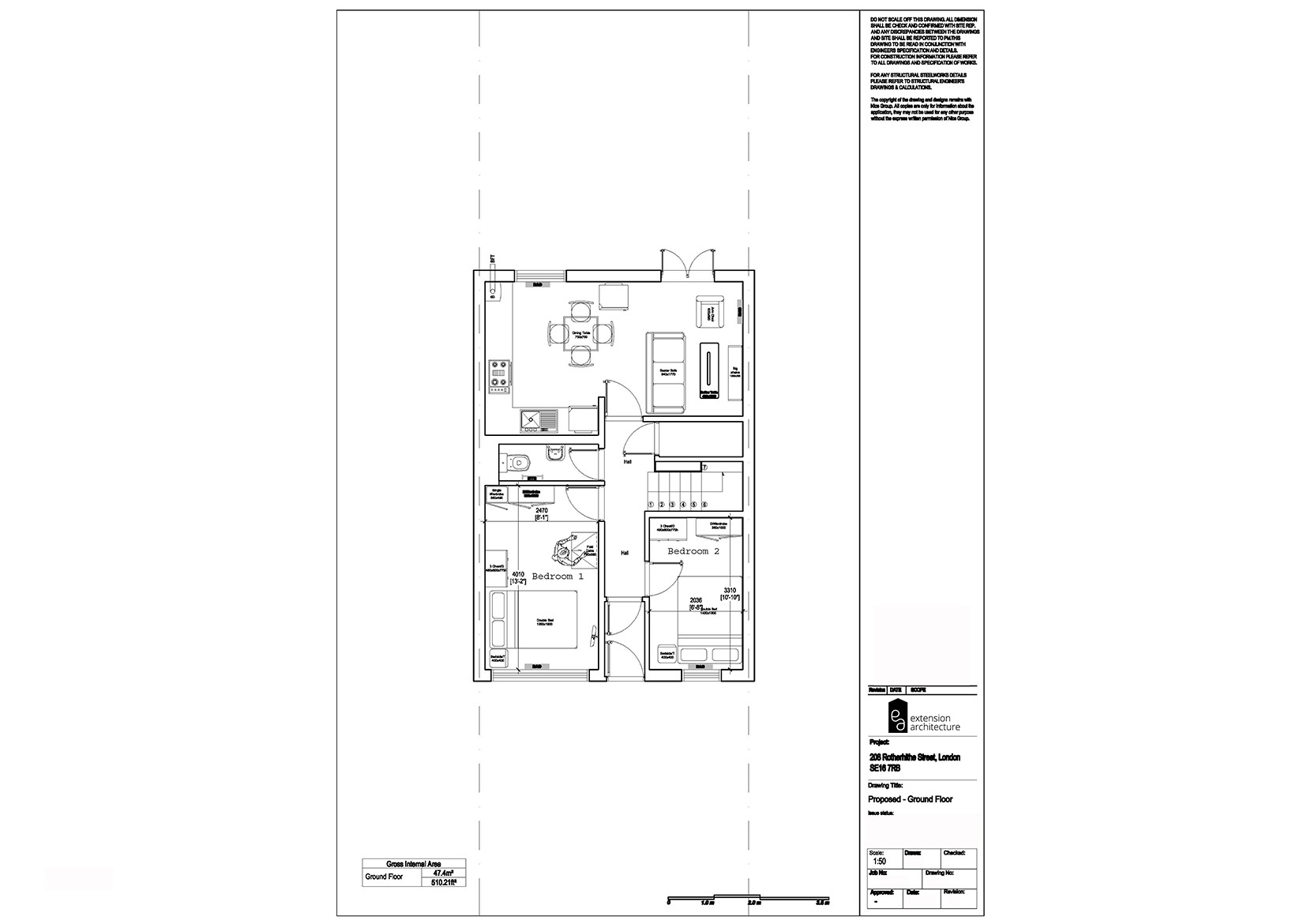

1. Start by Planning your Budget

- Set the budget based on your income.

- If you are planning to buy a house in north London, or to buy a house in central London, you must plan accordingly as they have two different price points.

- Research property prices thoroughly as mentioned above. To buy a house in north London requires a different budget and to buy a house in south London will cost you different for the same property dimension.

2. Get On a Mortage Agreement

This means if the property you are buying is worth £100,000 then your contribution towards the purchase as a deposit can be as low as £5,000, while the remaining £95,000 will be a mortgage. The issue however will be the high interest rate. Criteria such as your income, age (should be 18+), term of the loan, your financial history all will be considered.

3. Tax Liability

4. Hire a Conveyancer

For a standard property transaction, a conveyancer in London may typically charge between £900 to £1,700 plus VAT. The cost usually depends on the type and location of the property, complexity of the transaction, etc.

There are additional costs that incur with land registry fee, bank transfer fee, local search fee all adding up. So, make sure hiring a conveyancer is a part of your budget if you need one.

5. Start your Property Search

- If you are looking for a place which is to be at nearness to your work location and if you are required to commute to your work daily, then choosing the urban part of London would be perfect. Urban London has a well-connected transport system (Rapid Transit System) which is quite efficient and connects to all parts of the city. If your work life relieves you to work only for a few days at office in a week, then choosing a sub-urban location would be a good move.

- If your interest and priority is to enjoy the urban chaos with culture, then choosing urban London as your property location fits great. While North London is a bustling art & culture hub, South London has more of the green share with parks and other neighbourhoods and is less crammed with buildings. Central London is the heartbeat of the capital and is eclectic with mix of commerce, tradition, and culture.

- If cost is a deciding factor in your property search, then areas such as Barking & Dagenham, Thamesmead, Deptford, Croydon, Bexley can be considered.

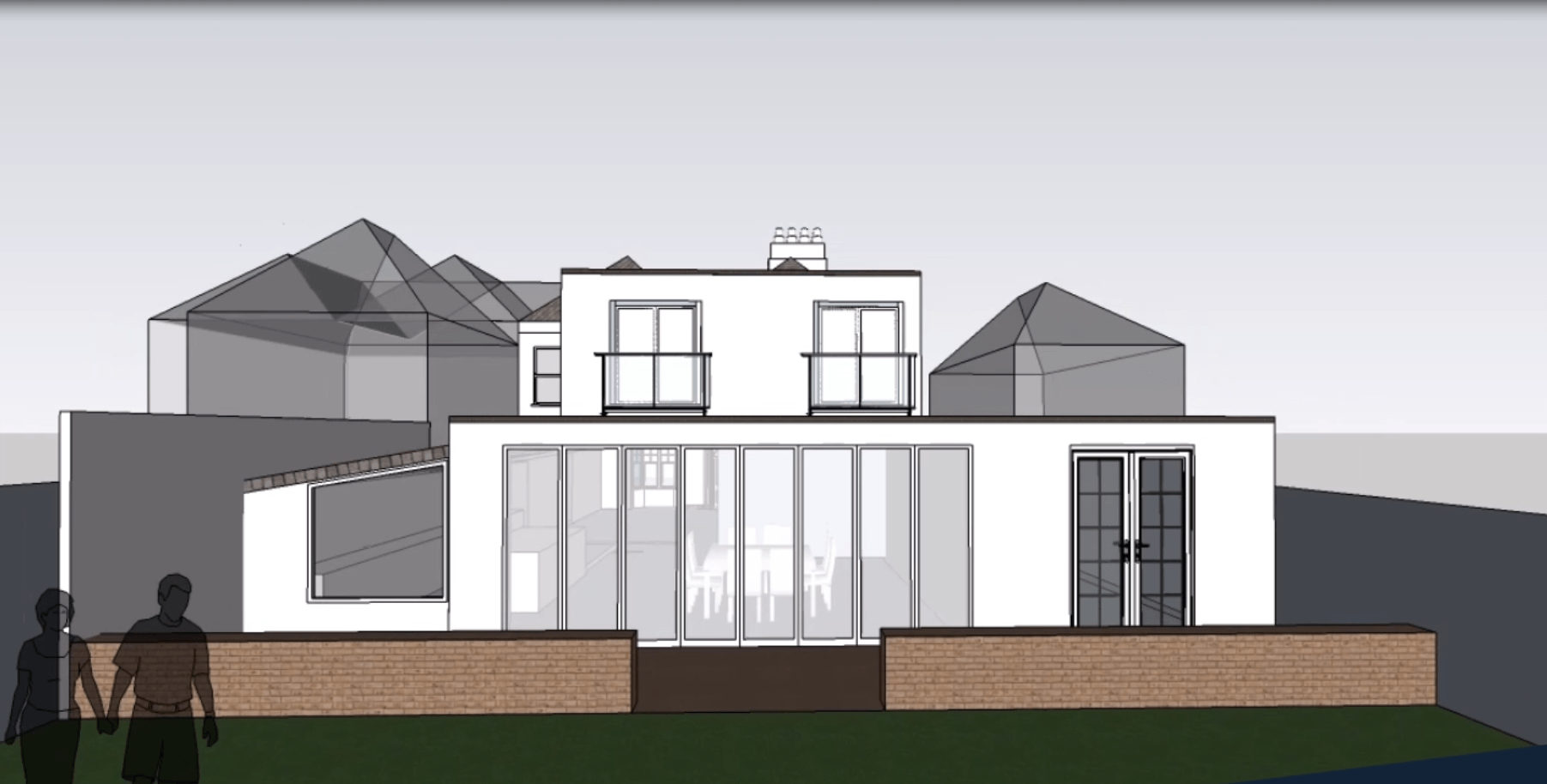

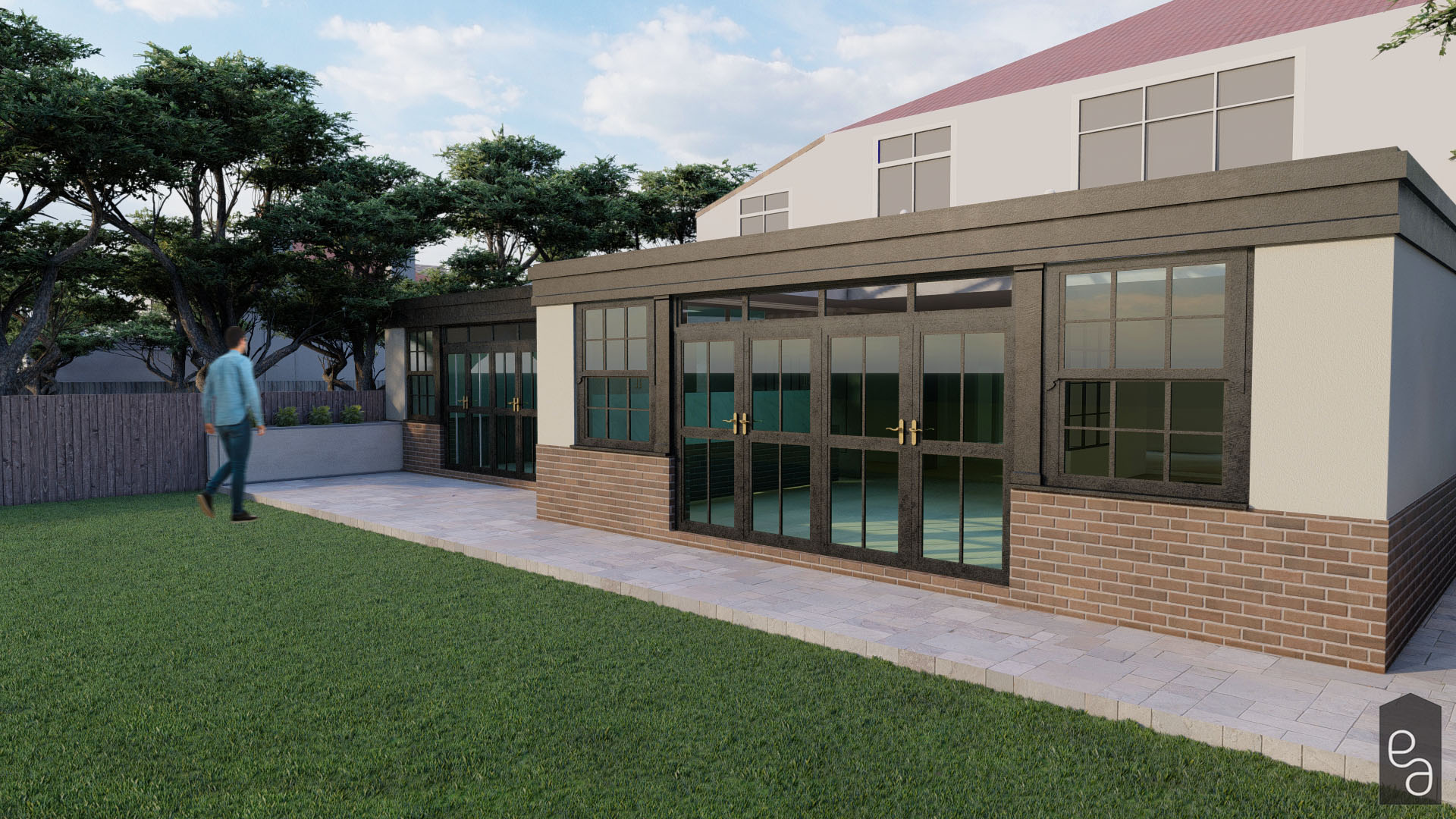

6. Buying the Property & Ensuring Basic Facilities

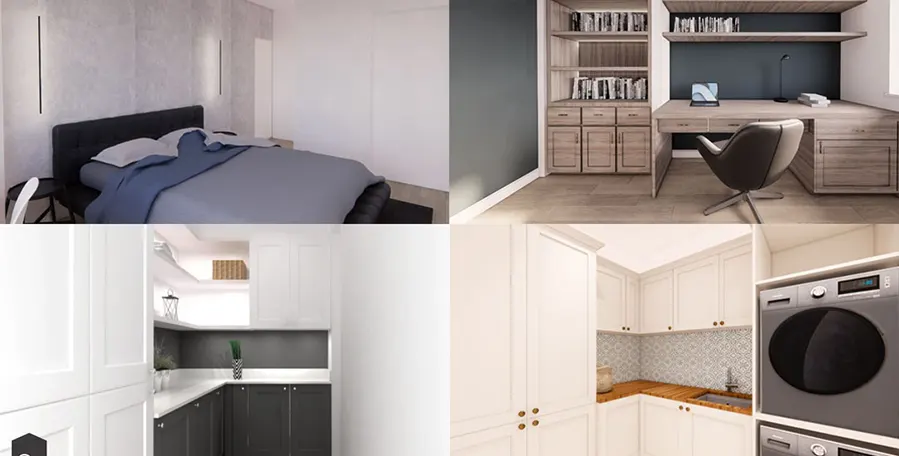

If not, make sure you know what are stakes when purchasing. The purchased property should include basic features such as electrical works, plumbing, proper insulation, heating facilities, adequate window installations, kitchen & bath equipment such as worktops, storage units, shower, sink, bathtub, toilet should all be included.

7. Seal the Purchase

Don’t Miss these Important Tips

- Hire an estate agent: Look for specialist agents such as Purplebricks, Connells Group, Hunters, Your Move, Reeds Rains, and there are many such.

- Go through Auctions: If you plan to buy through an auction, you can then subscribe to auction forums and magazines such as the EIG, Property Auctions News magazine, Estates Gazette Magazine, and London Auction House mailing lists, etc.

Tips for Successful Bidding at Auctions

- Research thoroughly and set realistic bidding budgets

- Make sure you attend auction previews to understand the condition of potential properties

- Consider proxy bidding as a strategic option

- Look Yourself (web/online): Go through websites specialising in property sales and if you like one better go and view the property yourself physically.

- Check if the property you are buying is registered under the Land Registry.

- Make sure all the documents pertaining to the property is secured.

- Make sure previous mortgages are paid off for the property you are buying.

- Make sure there are no previous arrears, legal issues, right-of-way agreements or any other encumbrances.

Conclusion