House Price & Sales in the UK 2025

Land registry’s UK House Price Index, one of the most trustable sources when it comes to data on house prices in UK states that the average property price in the UK rose to 3.3% between the end of 2024 and 2025. In fact, the UK house prices rose to around 3.4% at the start of the year and ended with a high of 4.7% in 2025. The year before that, prices saw a dip of 2.5%. The fact that this data is purely based on actual house sales and not on demand estimation or any prediction makes it an authentic and valid source.

Will House Prices in UK Soar in 2025?

A survey conducted by the RICS UK in December shows an upward trend in house sales with increased enquiries reported from new home buyers. The knock-on effect resulted in house price inflation of 3.3% in November 2024. With this, the average house price UK went up to £290,000 from the previous year’s average of £285,000.

Coming Back to the Surge in Queries

What is the Stamp Duty Land Tax (SDLT)?

Below are some amendments you need to be aware of –

If you are a first-time home buyer –

- 0% SDLT charges for houses up to £425,000 before 31st March 2025

- 0% SDLT charges for houses worth up to £300,000 after 31st March 2025

- 5% SDLT charges for houses that worth between £425,001 to £625,000 before 31st March 2025

- 5% SDLT charges for houses that worth between £300,001 to £500,000 after 31st March 2025

If you are moving your home –

- 0% SDLT charges for houses worth up to £250,000 before 31st March 2025

- 0% SDLT charges for houses worth up to £125,000 after 31st March 2025

- 2% SDLT charges for houses worth £125,001 up to £250,000 after 31st March 2025

- 5% SDLT charges for houses worth £250,001 up to £925,000 before 31st March 2025

- 5% SDLT charges for houses worth £250,001 up to £925,000 after 31st March 2025

- 10% SDLT charges for houses worth £925,001 up to £1,500,000 before 31st March 2025

- 10% SDLT charges for houses worth £925,001 up to £1,500,000 after 31st March 2025

- 12% SDLT charges for houses worth above £1,500,000 before & after 31st March 2025

After the rise in demand for house sales, let’s look at what’s transpired in the UK and England housing realm from the recent data put up by the government until November 2024 –

Average House Prices in UK by Region

England £306,000

Scotland £195,000

Northern Ireland £191,000

Wales £219,450

Average House Prices in England by Region

London £511,300

Northeast England £168,800

Northwest England £226,630

Southeast England £377,900

Southwest England £317,615

Average House Prices in UK by Property Type

Semi-detached £283,550

Detached £437,000

Terraced £243,000

Flat £232,000

Which are the Best Prospects for Buying a House in the UK?

The prospects are based on factors such as affordability, potential for faster selling, and the flexibility to cut demand prices to attract home buyers. Data below illustrates the housing market potential –

- Motherwell, Scotland tops with a house price at £129,055. A house price growth of 3.8% per annum and the lowest time sell a house being 13 days

- Paisley & Glasgow second top with an average house price at £134,500 & £157,800 respectively. A house price growth of 1.3% & 3% respectively, and a time to sell a house at an average of 15 days

- In England, Sunderland topped with an average house price at £119,200 with a house price growth of 2.4% per annum and the average time to sell a house being 30 days

- Durham & Newcastle follow with an average house price at £140,500 & £160,800 respectively with a house price growth at 3.8% & 2%, and with time to sell a house clocking at an average of 30 days

Wigan, Oldham are doing great with house price estimates stated for 4.5% to 5% year on year and a combined average price at £174,200.

How Will This Impact Mortgage Rates?

This year, i.e. in 2025, the good news for home buyers is of a strong possibility on cuts on interest rates to an extent of up to 4 times to encourage and boost economic activity. This is strongly backed by market assessments and predictions from at least 51 economists which should mean that there is a high chance that this turns out to be true. If it does, this will bring about a huge transformation especially where house prices are expensive; London will likely experience a good growth particularly in the southwest, east, and southeast.

What is in for Renters?

Rents in 2025 are set for an increase, but not substantially. The rise will see a slower pace and factors such as mortgage rates, government support, economic policies will all add up to this. With SDLT coming into the picture pushing for increased enquiries, landlords will likely take advantage of this to sell up. According to a report, there were 11 enquires for one potential rental property, a huge increase compared to 6 enquiries recorded a couple of years ago.

Currently the figure is 2.5% increase in rental costs across the UK, which is not too bad for tenants. 2025 may see an increment in rental costs across the UK, but London may still remain on the lower side.

Conclusion:

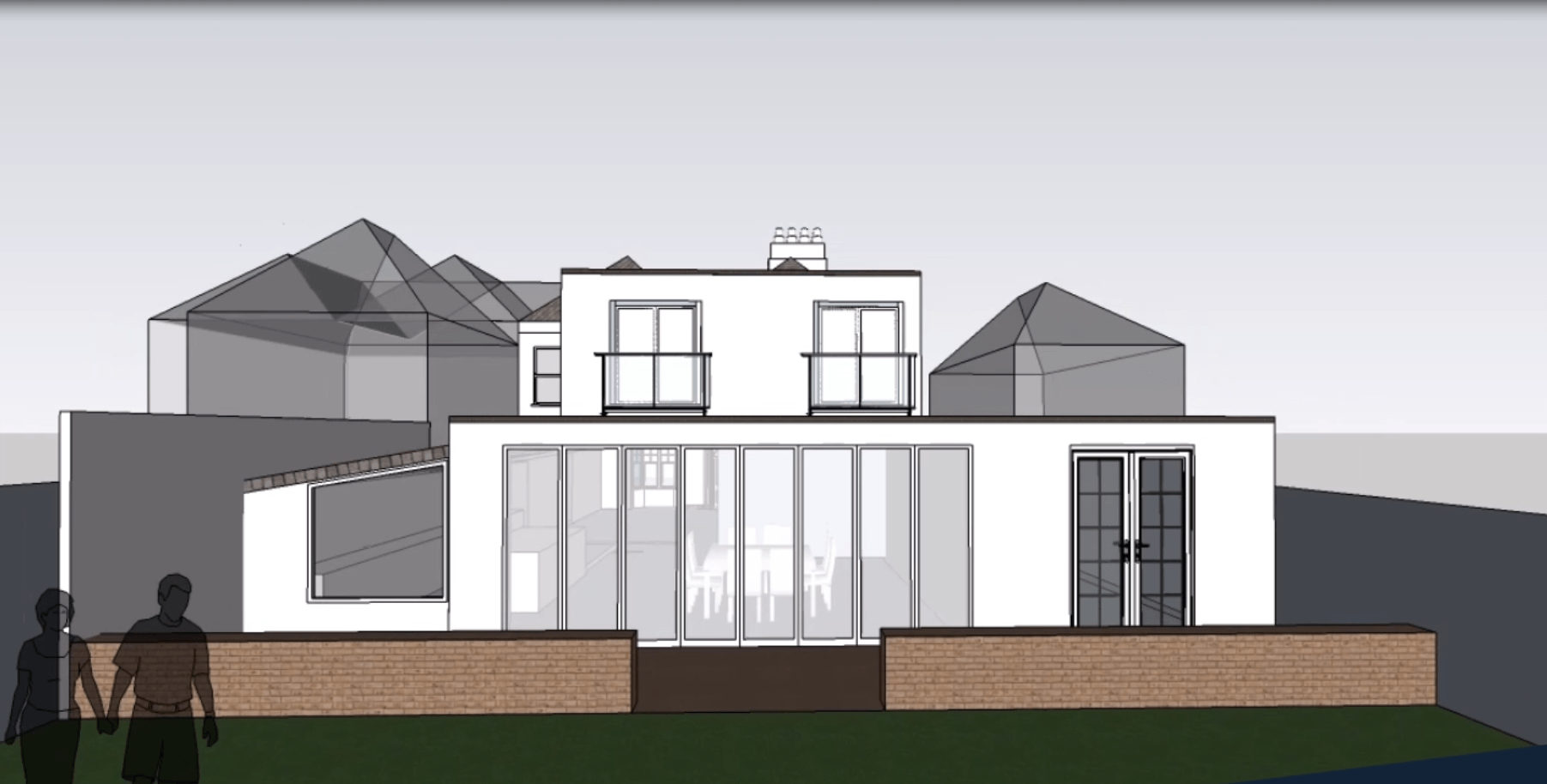

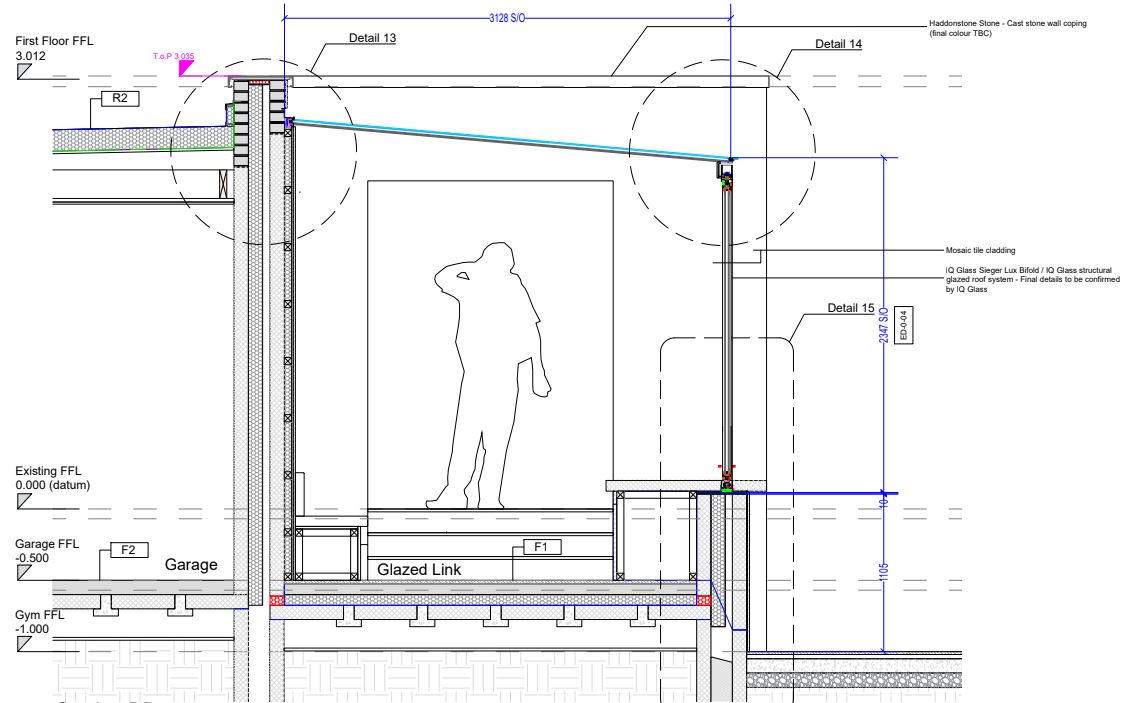

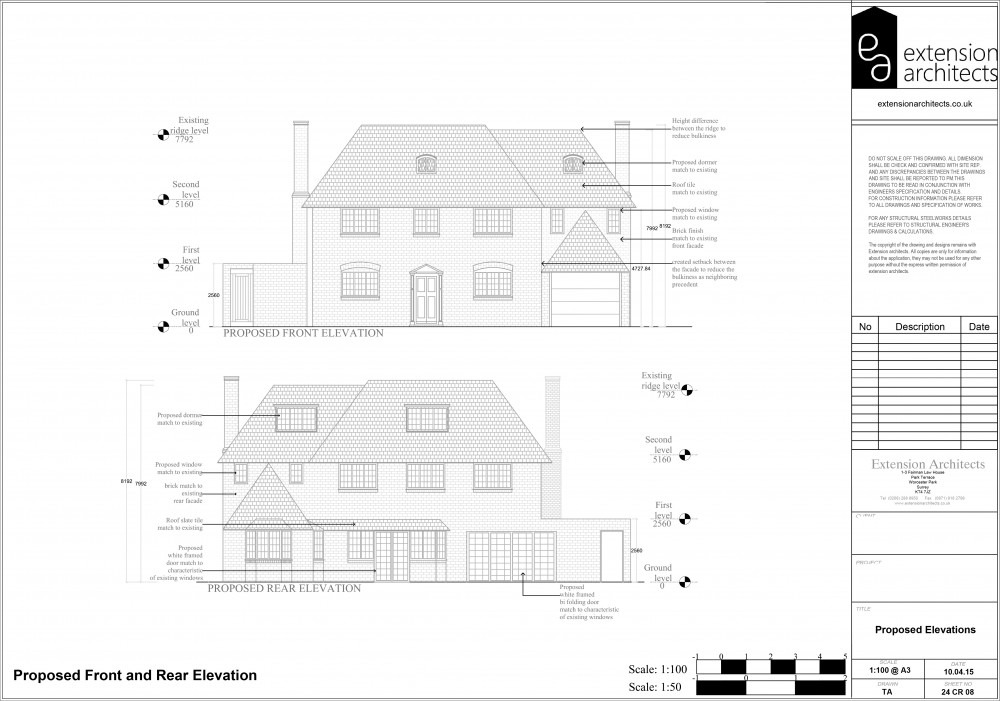

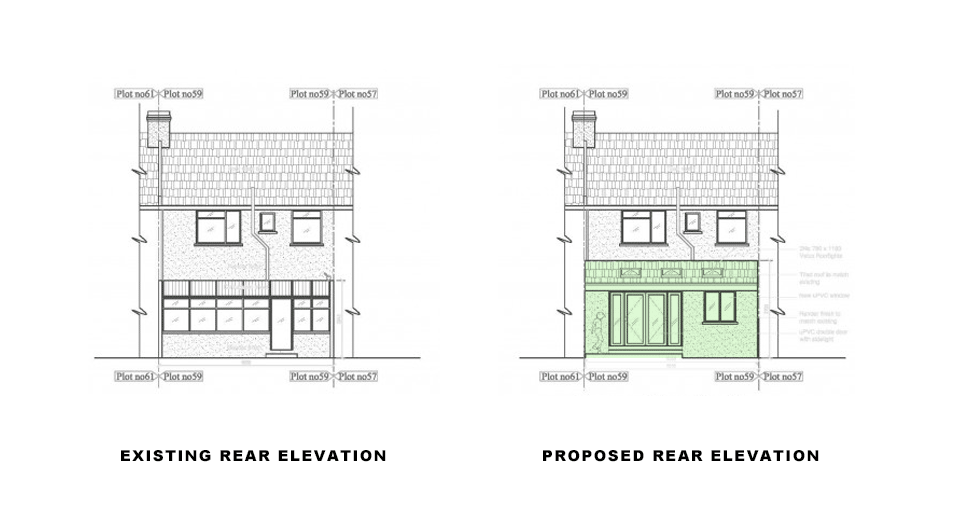

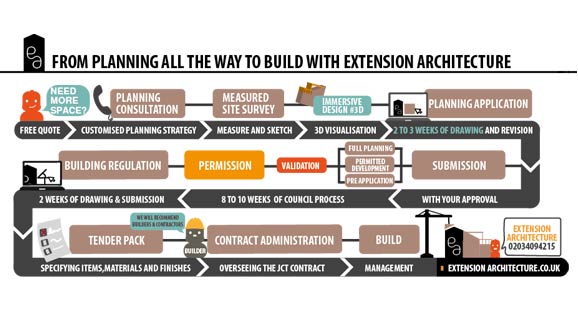

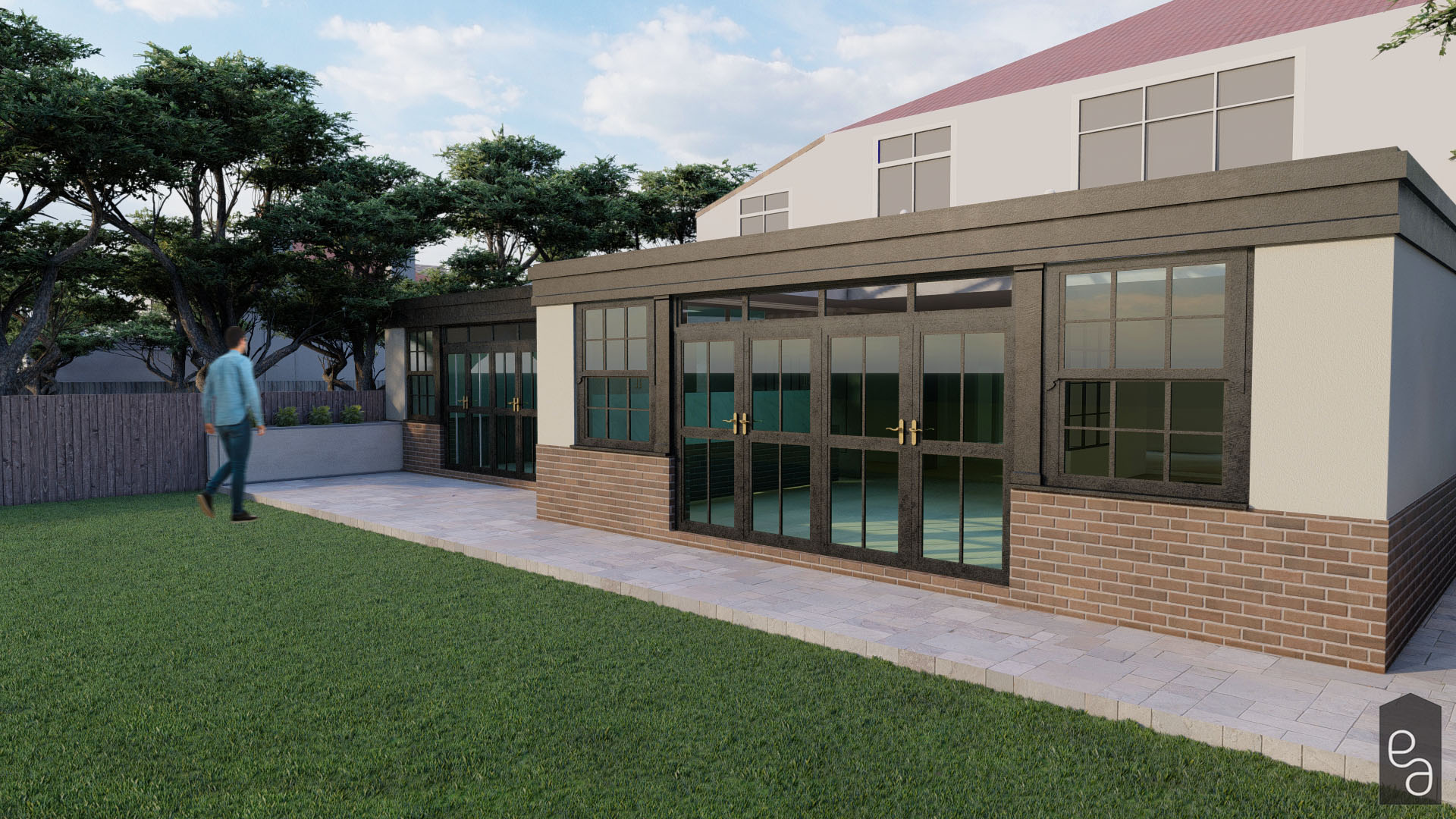

At Extension Architecure, we bring to you the latest with housing and its impact on homeowners, renters, realtors, and for the people in general. Keep a tab on our space to hear all about industry happenings, paradigm shifts in construction & architecture and how they are affecting you and your endeavours. Contact us for more Details.