The Importance of Updating Your Home Insurance While Building an Extension

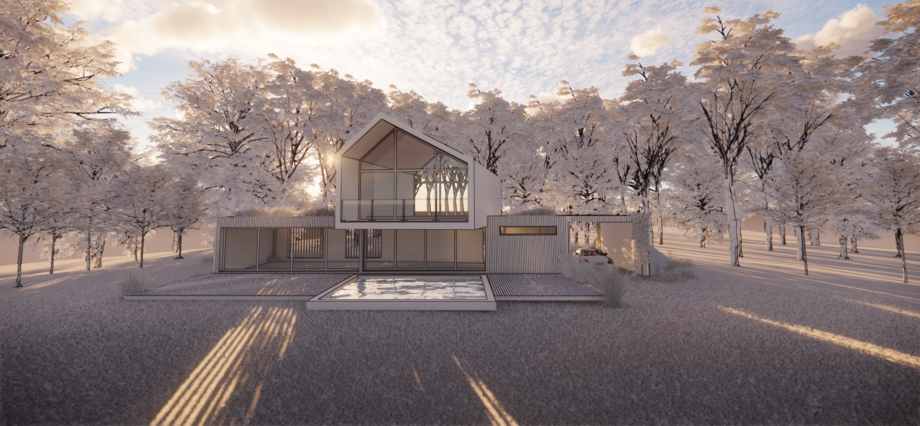

Building an extension on your home is an exciting and rewarding experience, but it also comes with its fair share of risks. One of the most important things you need to do before starting any construction work is to update your home insurance policy. In this article, we'll explore the reasons why updating your home insurance is essential when building an extension and what you need to consider.

What is Home Insurance?

Home insurance is a type of insurance policy that provides coverage for your home and its contents. It typically covers damage to your property caused by events such as fire, theft, and natural disasters. It can also cover liability claims if someone is injured on your property.

Why is it Important to Update Your Home Insurance When Building an Extension?

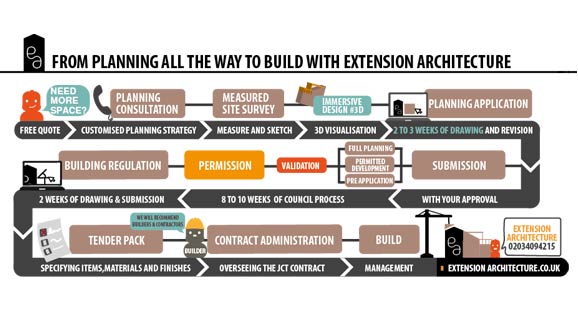

Building an extension on your home is a significant investment, and it’s essential to make sure your insurance policy covers any potential risks that may arise during the construction process. Here are some of the reasons why updating your home insurance is crucial when building an extension: Steph Fanizza, Architectural Design & Team Manager

Tell us about your plan and we'll send you a free quote! It takes less than 60 seconds!

2. Protecting Your Investment

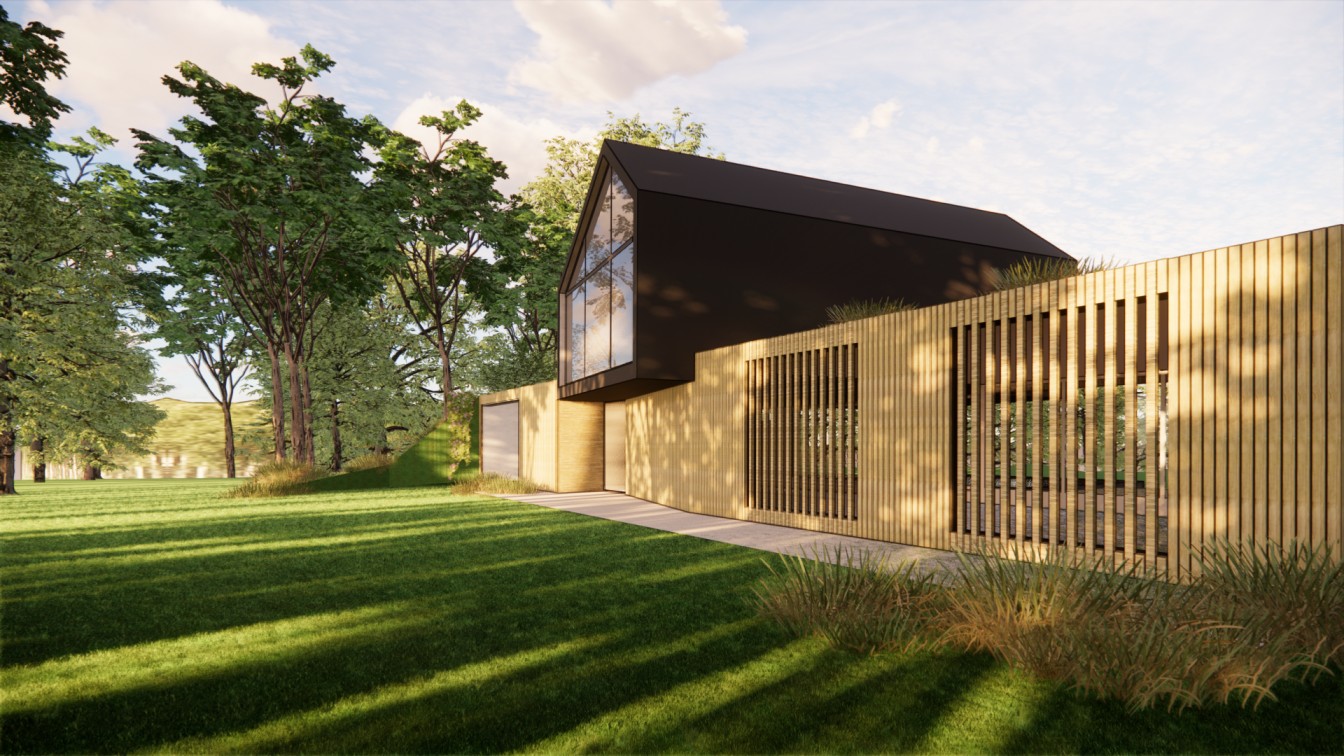

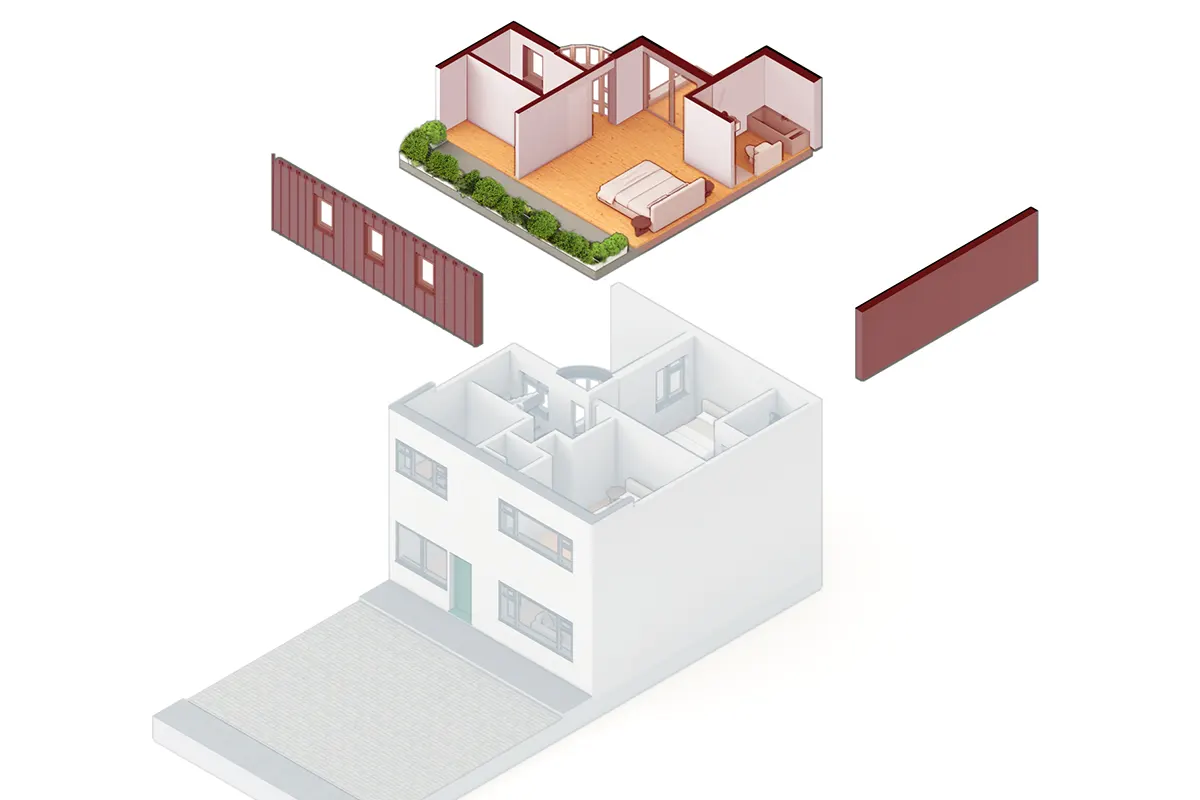

An extension is a significant investment, and it’s crucial to make sure it’s protected. Updating your home insurance policy can ensure that your investment is protected in case of any unforeseen events that may occur during the construction process.3. Liability Coverage

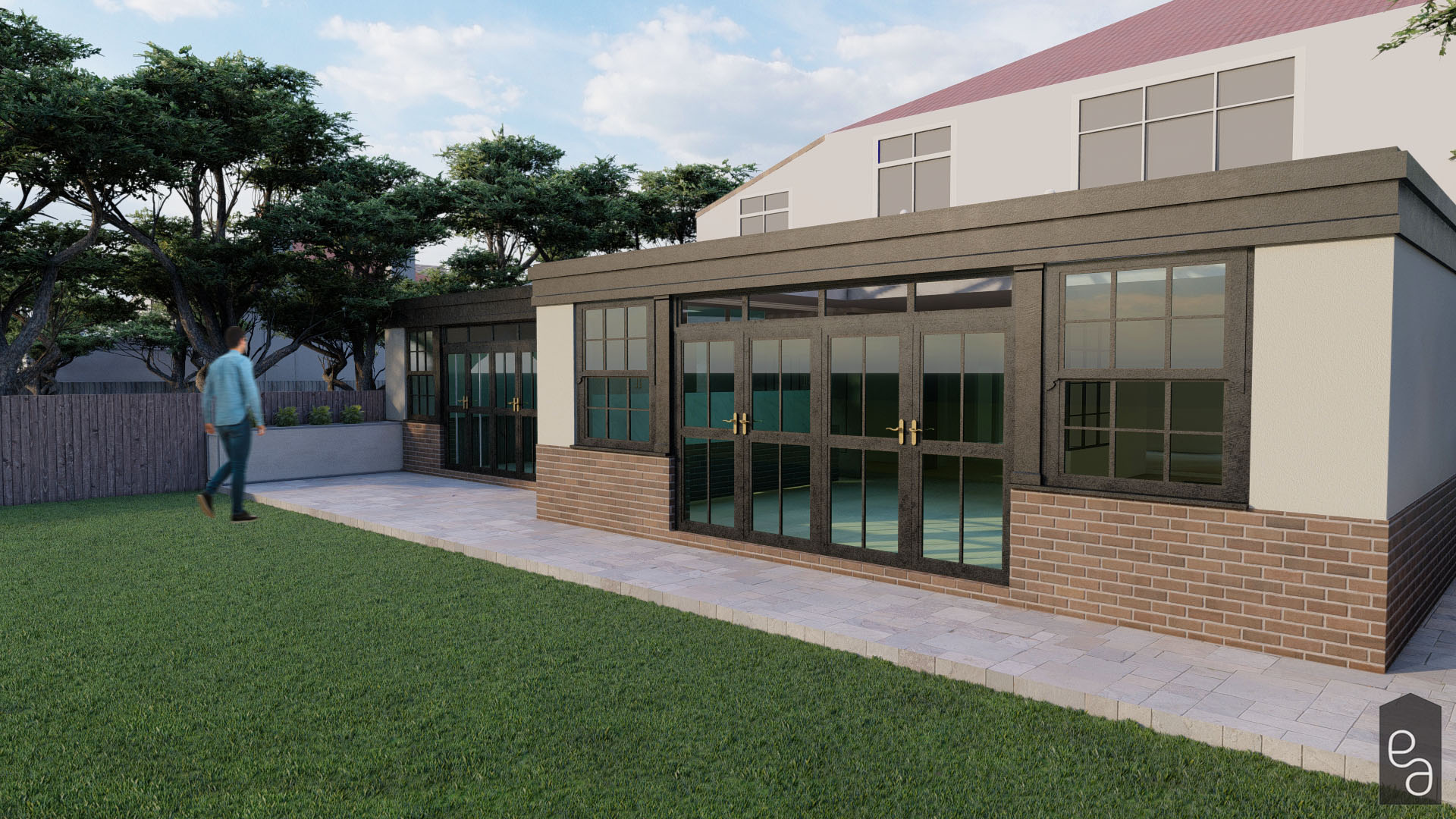

Building an extension involves hiring contractors and subcontractors who will be working on your property. Liability coverage is essential to protect you from any claims that may arise due to injury or damage caused by the construction workers.

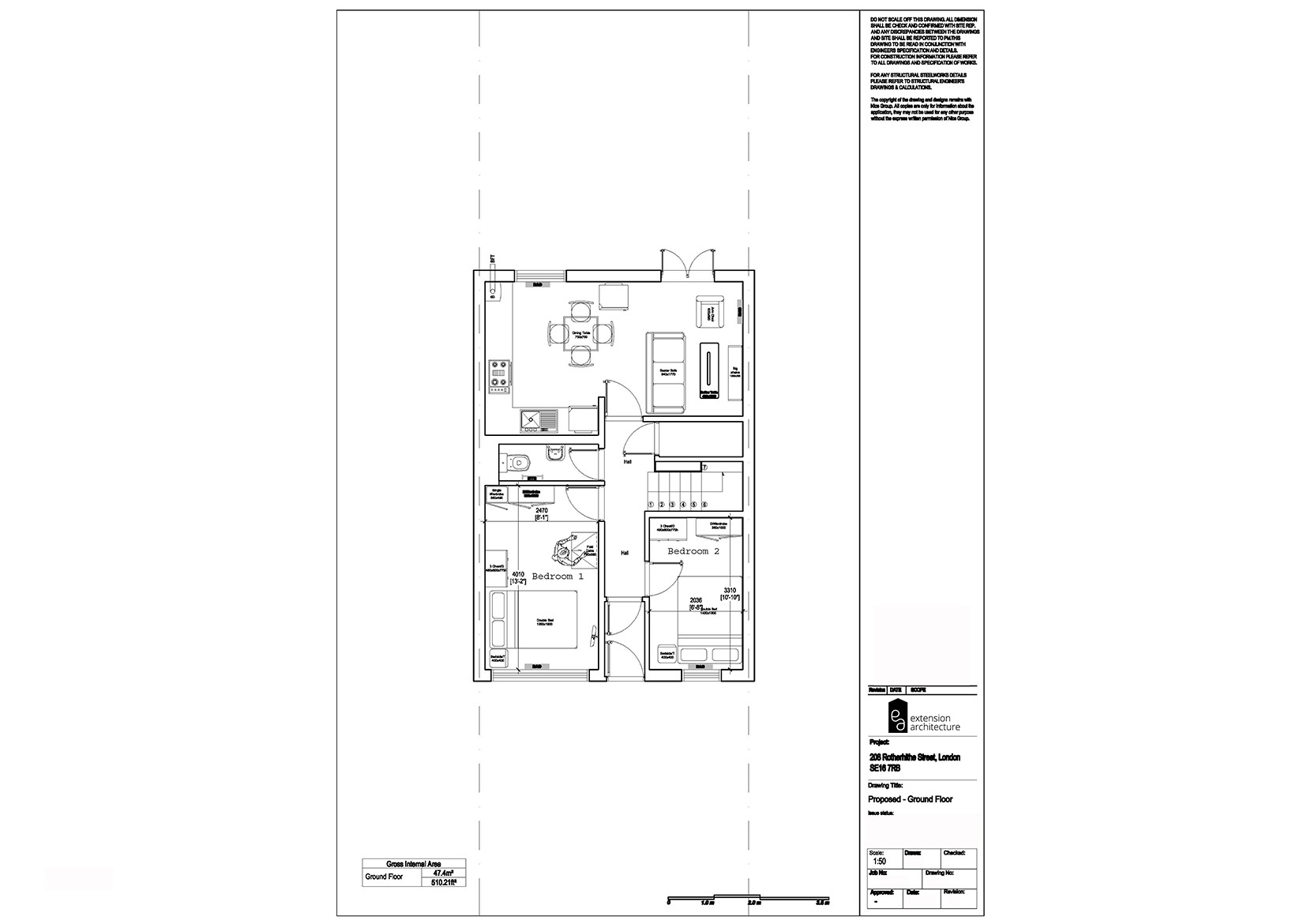

4. Home Value

Building an extension can increase the value of your home. Updating your home insurance policy can ensure that your insurance coverage reflects the increased value of your home.

What to Consider When Updating Your Home Insurance

When updating your home insurance policy, there are several things you need to consider to make sure you have the right coverage for your needs. Here are some of the things you need to consider:

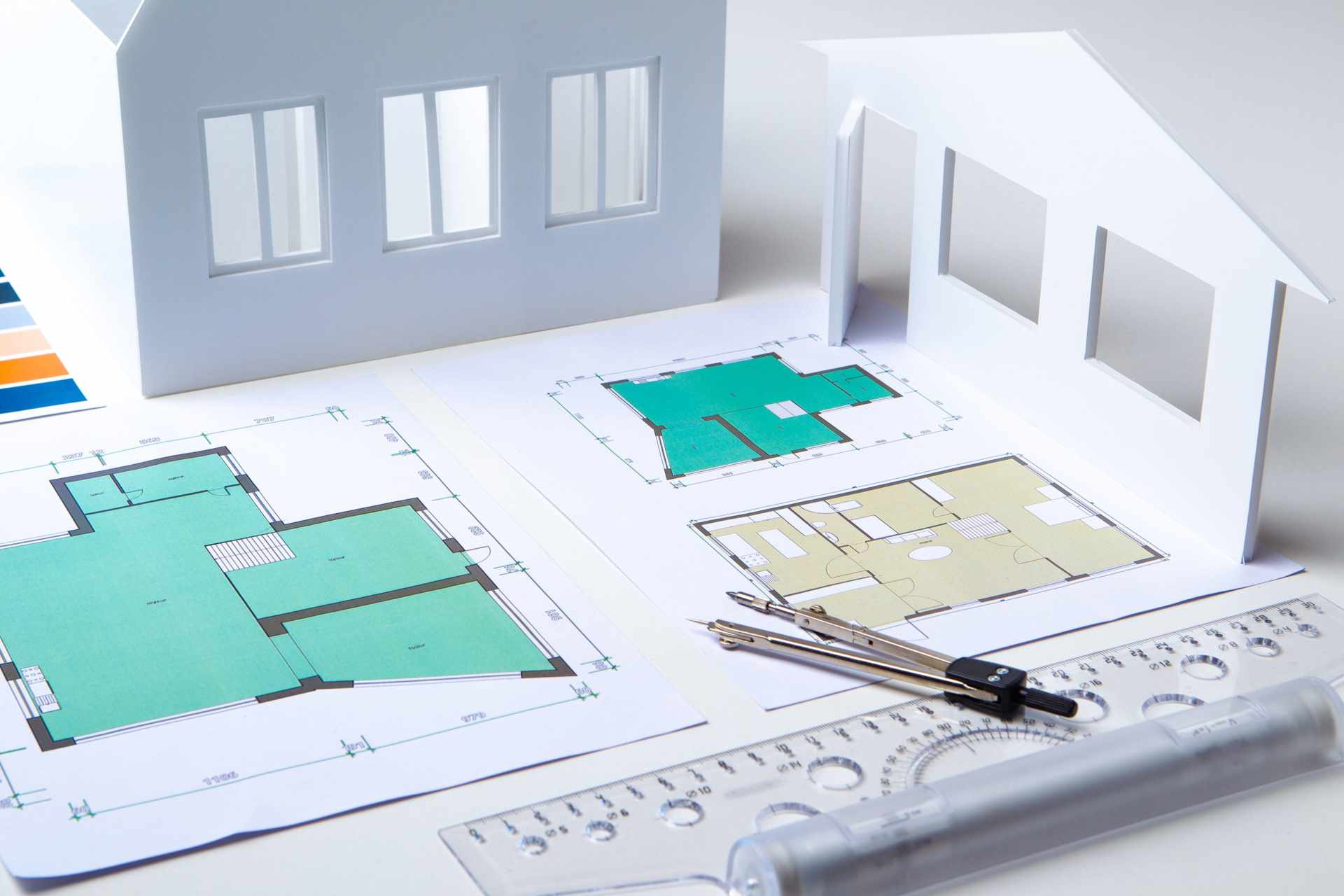

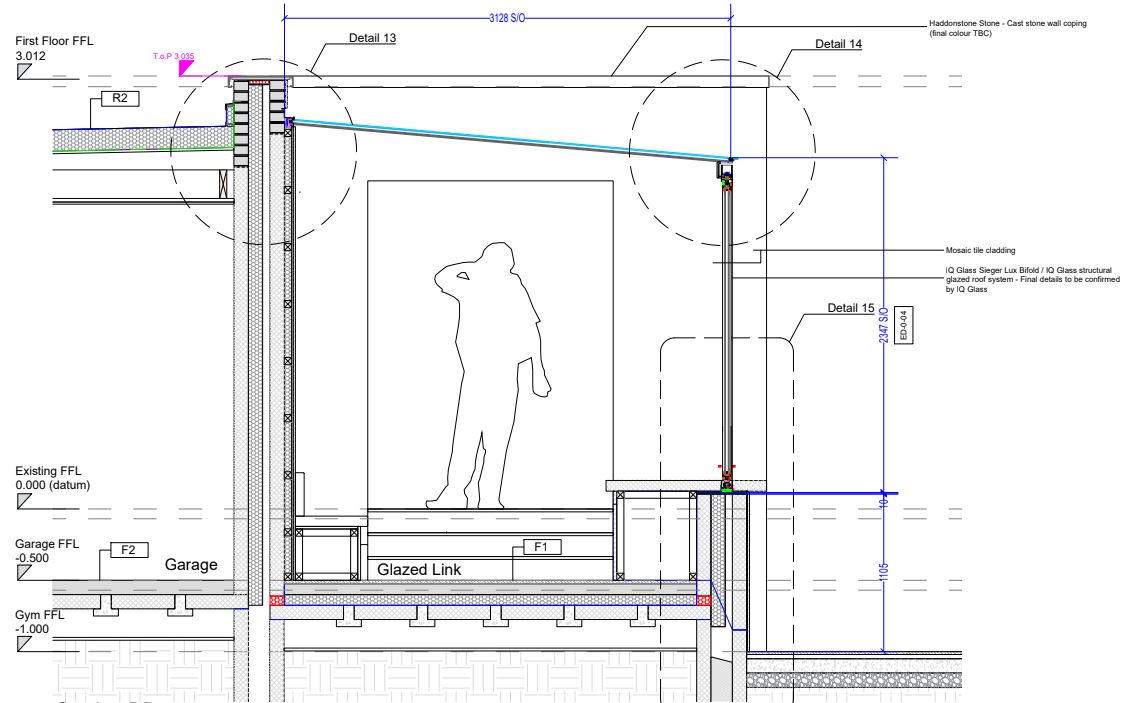

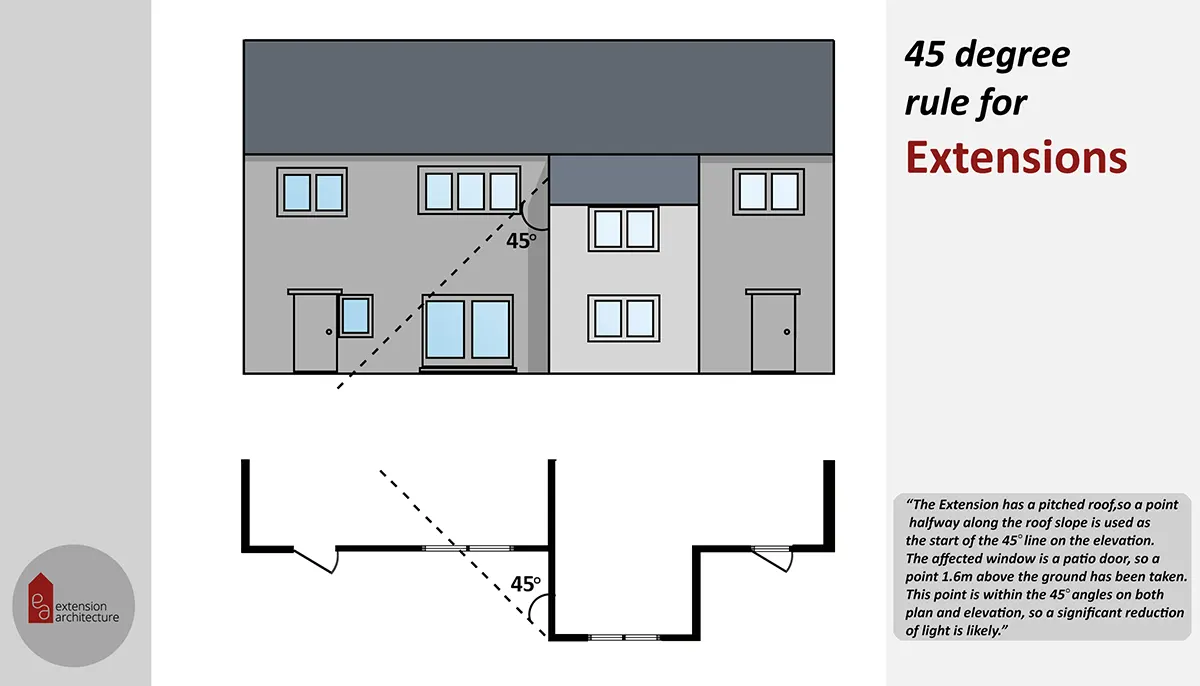

1. Construction Materials

Make sure your insurance policy covers the cost of the construction materials. The cost of materials can add up quickly, and it’s essential to make sure you’re covered in case of any damage or theft.

2. Building Permit

Make sure your insurance policy covers any damages caused during the construction process. Some insurance policies may not cover damages caused by construction without a building permit.

3. Builder’s Risk Insurance

Builder’s risk insurance is a type of insurance policy that covers any damage that may occur during the construction process. This type of insurance is typically purchased by the contractor, but it’s essential to make sure you’re covered in case of any damages that may occur during the construction process.

4. Liability Coverage

Liability coverage is essential to protect you from any claims that may arise due to injury or damage caused by the construction workers. Make sure your insurance policy provides adequate liability coverage.

5. Coverage Limits

Make sure your insurance policy covers the full cost of the extension. Coverage limits can vary between insurance policies, and it’s essential to make sure you have enough coverage to cover the cost of the extension.

Conclusion:

In conclusion, updating your home insurance policy when building an extension is essential to protect your investment and ensure you’re covered for any potential risks that may arise during the construction process. Make sure you consider all the factors mentioned above when updating your policy to ensure you have the right coverage for your needs. Consult with your insurance provider to understand your coverage options and ensure you have the best policy